Time Series Forecasting

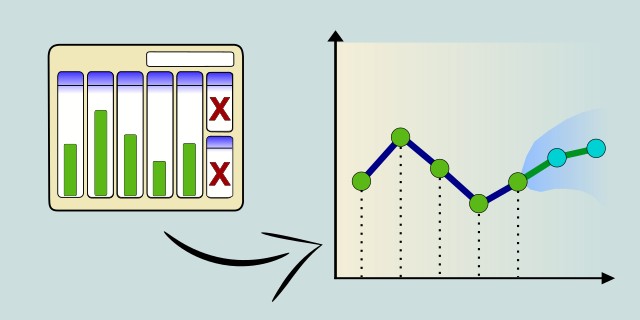

Time series forecasting is a technique used to predict future values based on previously observed values. It is widely used in various fields such as finance, economics, and environmental science to analyze trends and make informed decisions.

What type of patterns exist in your time series data?

Is your time series mostly linear with clear trends and seasonality, or does it have complex, non-linear temporal dependencies?

Tips:

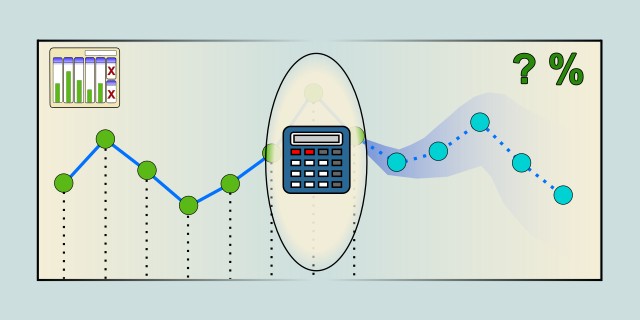

- If your data is stationary or can be made stationary, and shows clear trends or seasonality, choose ARIMA.

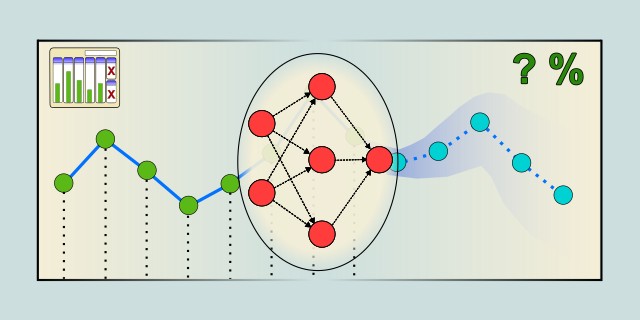

- If your time series data is long, has non-linear patterns, or depends on long-term memory, choose LSTM (Long Short-Term Memory).

ARIMA

ARIMA (AutoRegressive Integrated Moving Average) is a popular statistical model used for analyzing and forecasting time series data. It combines autoregressive terms, differencing (to achieve stationarity), and moving average components to model complex temporal patterns.

ARIMA is well-suited for univariate time series forecasting when the data shows trends or seasonality after differencing. It requires the series to be stationary or made stationary through differencing. Model selection involves identifying the order of autoregression, differencing, and moving average components (p, d, q). ARIMA can be computationally efficient but may struggle with very complex or nonlinear patterns compared to modern deep learning methods.

Use Case Examples:

- Sales Forecasting: Predicting future product sales based on historical data.

- Stock Price Prediction: Modeling price trends and volatility over time.

- Weather Forecasting: Short-term predictions of temperature or precipitation.

- Energy Demand Forecasting: Estimating future electricity usage for grid management.

- Economic Indicators: Forecasting inflation rates or unemployment trends.

| Criterion | Recommendation |

|---|---|

| Dataset Size | 🟡 Medium |

| Training Complexity | 🟡 Medium |

LSTM

LSTM (Long Short-Term Memory) is a type of recurrent neural network (RNN) designed to capture long-term dependencies in sequential data. It excels at modeling complex temporal patterns and nonlinear relationships in time series.

LSTM networks overcome the vanishing gradient problem common in traditional RNNs, making them highly effective for time series with long-range dependencies. They require larger datasets and more computational resources compared to classical models like ARIMA. LSTMs are widely used for forecasting tasks where patterns are nonlinear or involve multiple influencing factors. Proper tuning and sufficient training time are crucial for optimal performance.

Use Case Examples:

- Stock Market Prediction: Forecasting future stock prices considering past trends and volatility.

- Weather Forecasting: Predicting complex weather patterns such as rainfall or temperature.

- Speech Recognition: Modeling sequences in audio signals over time.

- Energy Consumption: Predicting future energy usage based on historical consumption data.

- Healthcare Monitoring: Forecasting patient vital signs over time for early intervention.

| Criterion | Recommendation |

|---|---|

| Dataset Size | 🔴 Large |

| Training Complexity | 🔴 High |

Feedback & Sharing

Give us your thoughts on this page, or share it with others who may find it useful.

Feedback

Found this helpful? Let me know what you think or suggest improvements 👉 Contact me.